PUBLIC FINANCE

Governments are still spending billions subsidizing oil, gas and coal. We need to #StopFundingFossils and start investing in the future.

OVERVIEW OF WORK

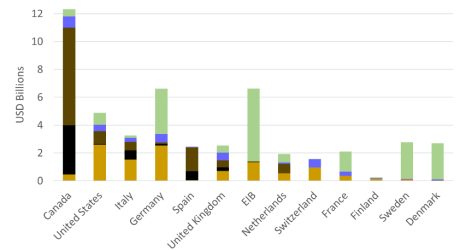

Since the Paris Agreement, G20 governments have continued to finance more than USD 77 billion dollars annually in fossil fuels through multilateral development banks (MDBs), bilateral development finance institutions (DFIs), and export credit agencies (ECAs). This is three times the support they provide to clean energy. Beyond providing this direct monetary backing, these institutions reduce perceived risk and provide a government stamp of approval on fossil fuel projects that often serves to crowd in private finance. While recently the level of fossil fuel support has started to drop, institutional policies to exclude fossil fuel finance are needed to ensure this progress continues.

While a number of public finance institutions committed to ending coal finance in the early 2010s, it wasn’t until 2017, following years of campaign pressure by Oil Change and others, that the World Bank made a meaningful commitment to stop financing for upstream oil and gas. Following an intense campaign effort, in 2019 the European Investment Bank committed to ending nearly all oil, gas and coal finance. Recently, the UK announced it would end overseas oil and gas finance, and the EU and US, among others, have signalled that they intend to follow suit. Building off these successes, OCI is now working to secure further commitments from governments and public finance institutions on ending public finance for fossil fuels.

LATEST PROGRAM POSTS

As the deadline for implementing the Glasgow Statement looms, the Swedish export credit agencies, SEK and EKN, have released an updated policy. A previously-released policy aligned Swedfund - the Swedish development finance institution - with the Glasgow Statement. SEK and EKN’s new policy ends almost all support to fossil fuels by 31st December 2022, with some limited exemptions.

By Nina Pusic

Often hidden from public view, export credit agencies (ECAs) hold a make-or-break role when it comes to achieving the 1.5°C warming goals of the Paris Agreement and averting climate catastrophe. Their export support, in the form of loans, loan guarantees and insurance, helps domestic companies limit the risk of selling goods and services in overseas markets. ECA finance is government-backed, and often concessional, helping prop up fossil fuel projects and infrastructure which would otherwise be difficult to build. OCI data shows that if ECAs do not dramatically change course, they will push the world far beyond 1.5°C.

G20

39 countries and institutions signed a joint commitment to end any support for fossil fuels flowing abroad by the end of 2022, and in its place prioritize finance for clean energy. Recently the G7 reaffirmed their commitment and were now also joined by Japan, the only G7 member who hadn’t signed on. Here's what that means.

With hundreds of millions of people across the word suffering from the fallout of higher energy prices and a cost of living crisis caused by Russia’s deadly war on Ukraine, this week’s G7 summit was the perfect opportunity for the world’s most powerful politicians to show clear compelling leadership.

LATEST PROGRAM RESEARCH

Despite the urgent need to phase out fossil fuels, Japan is driving the expansion of liquified gas (LNG) and other fossil-based technologies like ammonia co-firing, worsening the climate crisis and harming communities and ecosystems.

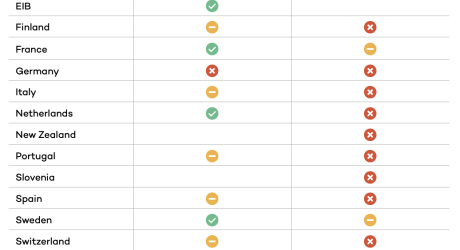

*Updated February 2024* Oil Change International analysis shows that several major countries continue to pump $6.2 billion in public finance into international fossil fuel projects despite committing to end this support by the end of 2022.

New research shows that Organisation for Economic Co-operation and Development (OECD) countries supported fossil fuel exports by an average of USD 41 billion from 2018-2020, almost five times more than clean energy exports ($8.5 billion).