Sen. Mitch McConnell claimed recently that the Keystone XL Pipeline “doesn’t require a penny of our taxpayer money all the president has to do is approve it.” But our research reveals many places that the pipeline project benefits from taxpayer subsidies.

Sen. Mitch McConnell claimed recently that the Keystone XL Pipeline “doesn’t require a penny of our taxpayer money all the president has to do is approve it.” But our research reveals many places that the pipeline project benefits from taxpayer subsidies.

The refineries that are linked to the Keystone XL tar sands pipeline as committed shippers will receive between $1 billion and $1.8 billion in tax breaks. They are paid specifically for investing in equipment to process the heavy sour oil the pipeline promises to deliver.

The largest of these refineries, Motiva, is half owned by Saudi Refining Inc., and will receive between $680 million and $1.1 billion in U.S. taxpayer support.

Keystone XL, like all oil industry projects, is enabled by substantial taxpayer subsidies. Three of the refineries that are planning to process the pipeline’s oil have invested in special equipment to handle the extra heavy tar sands oil. According to our conservative estimates, the U.S. taxpayer is subsidizing these investments to the tune of $1.0-1.8 billion. Here’s how it works.

Tar sands oil is not like most other crude oil. It is a semi-solid bituminous sludge that has to be diluted with much lighter oil in order to be transported by pipeline. Once it arrives at a refinery, the diluent is removed and the bitumen is refined into petroleum products using special equipment. The equipment required includes cokers and hydrocrackers.

In anticipation of the Keystone XL pipeline, three refineries in Port Arthur, Texas have added this equipment in order to be able to profitably process the bitumen. Their goal is to maximize their production of high value fuels such as gasoline and diesel rather than be left with less valuable fuels such as residual oil (for shipping and industrial burners) and Petroleum Coke, a coal like substance that is burned in aluminum smelters and the like. Heavy oil yields high proportions of these less valuable fuels if you do not have the specific equipment to increase the higher value yield.

Special tax rules apply to these investments that are unique to the refining industry. Title 179C of the tax code allows the refining companies to deduct the value of these investments from their tax returns at a highly accelerated rate. Rather than spread the expense over the life time of the equipment, say 20-30 years, the refiners are allowed to expense (i.e., deduct from their taxable income) 50% in the first year and expense the rest through the next 9 years. This is tantamount to a massive interest free loan from the taxpayer to big oil refiners, making it cheaper for them to process a particularly dirty form of foreign oil. In the case of the three Port Arthur refineries preparing to process Keystone XL crude, we calculate this to cost the taxpayer between $1.0 billion and $1.8 billion.

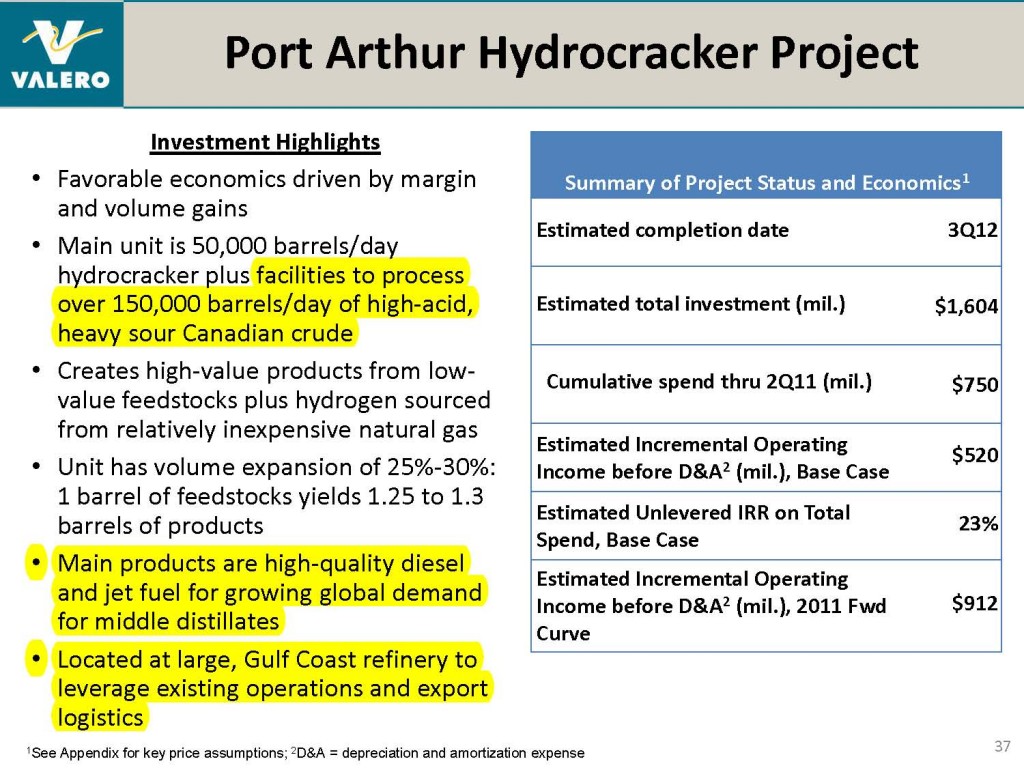

In the case of the Valero Port Arthur refinery’s hydrocracker project, the company has described the project to investors as one that will enable the refinery to process Canadian heavy oil into diesel and jet fuel for the export market. See below.

Does that look like the ‘national interest’ to you?

Does that look like the ‘national interest’ to you?

Of the three refineries involved, two of them, Valero Port Arthur and Total Port Arthur made these investments explicitly to process Canadian heavy oil that would be delivered by Keystone XL. Both companies are committed shippers on the pipeline meaning they have signed contracts committing them to a specific proportion of the pipeline’s capacity.

The other refinery, Motiva Port Arthur, jointly owned by Shell and Saudi Aramco, is expected to take some Keystone XL oil but it is also expected to use the new equipment to process large quantities of heavy sour oil imported from Saudi Arabia.

When the work finishes later this year, this refinery will become the largest in the United States. It will have the capacity to process up to 325,000 barrels per day of heavy sour oil. The United States is not a significant producer of heavy sour oil. Countries that are expected to increase their production of this difficult-to-process crude include Canada (tar sands), Venezuela, Colombia, Saudi Arabia and Kuwait among others. So the subsidy received by this refinery is directly to enable the processing of a particularly dirty form of oil that is not produced in America.

Hmm, what was it pipeline proponents, including the owners of these refineries, were saying about reducing dependence on oil from hostile and unstable countries?

The special tax treatment of refinery investments that allows the 50% accelerated depreciation was introduced in the 2005 Energy Policy Act and was targeted at refinery investments that expand the capacity of the refinery. However, in August 2011, the act was amended specifically to extend the tax break to refinery investments that enable the refinery to process tar sands oil or enable an increase in capacity to refine tar sands oil if the new equipment is commissioned between 2008 and 2014. All of these projects qualify.

We have calculated the value to these three companies of this accelerated depreciation for the investments listed in the table below. These investments were made specifically to process heavy sour oil in refineries closest to the terminus of the proposed Keystone XL pipeline and owned by companies who are known committed shippers on the pipeline.

Finally, all the refineries that will receive Keystone XL tar sands crude operate are in a Foreign Trade Zone (FTZ), which gives tax benefits to companies that use imported components to manufacture items within the United States (FTZ Act – 19 USC 81a-81u). Usually, refineries importing oil tax-free will still pay taxes when selling the refined products into the U.S. market. By both importing into and exporting from foreign trade zones the companies will avoid paying tax on the product sales. In other words, it’s a great deal for the oil industry, and a raw deal for the taxpayer.

Nobody in the oil industry can claim that Keystone XL, or any other oil and gas project, is free of taxpayer support. The subsidies we have revealed here are just a few examples among many forms of fiscal support to Keystone XL and the tar sands industry. Further, the full costs of our oil addiction in terms of health, environment and security are never included in an official analysis of these projects.

The public has the right to both know how our money supports Big Oil and see a thorough evaluation of any proposal the oil industry has for expanding its infrastructure. Such an examination would throw light on the true costs of expanding fossil fuel infrastructure at a time when we need to reduce our dependence on oil, rather than simply trumpeting the short term benefits to companies involved. Now that the project has been stopped, the true cost of Keystone XL is only just coming to light.

For full details of our analysis see here.

Table: Three refinery refit projects intended for processing Keystone XL oil

|

Project |

Company |

Investment ($millions) |

Value of accelerated depreciation ($millions) |

|

Port Arthur Hydrocracker Project |

Valero |

1,604 |

156-273 |

|

Port Arthur Coker |

Total S.A. |

2,200 |

214-375 |

|

Port Arthur Expansion |

Motiva Enterprises (Shell and Saudi Aramco) |

7,000 |

680-1,192 |

|

Total |

|

10,804 |

1,050-1,840 |

The refiners will receive another tax-free benefit, because Port Arthur is in a “Foreign Trade Zone” which really means “free tax zone.” The refiners do not have to pay any taxes and custom duties on the importing and exporting of petroleum products.

Holy Cow!

Congress is currently working to write a law to get around President Obama’s refusal to approve the pipeline without independent studies. The two parts I happened to catch on Cspan were to use an executive order from George Bush for the first Keystone Pipeline to force this new pipeline on the nation. I could tell which members of the committee had accepted big money from big oil companies.

In looking at your analysis I have three questions for clarity. First, you assume that the companies have all claimed a deduction under section 179C, is there any specific proof that they have done so or met the full requirements laid out in 179C? Second, your numbers are based upon a differential from a straight-line economic life and you disregard the depreciation life afforded the Code. However, in doing economics and deciding whether the cash flow impact of 179C, why would an investment analysis on the 179C benefits not determined against the current MACRS recovery? In that case the differentials are much less. Finally, you note that the KXL crude is going into a FTZ which allows the crude to escape duties and tax. However, isn’t the crude already exempt from customs duties because of NAFTA? If so, what taxes are specifically avoided because of the FTZ?

Enough already! This nation is already an Oligarchy it need not be increased.

This is outright thievery. This also shows the misrepresentation by the Government.

We must stop this.

thanks for this detailed breakdown. Gives another argument against the pipeline. though again who is suprised by the results.

any great lakes rep or senator who votes for XL pipeline should promise nebraska access to great lakes water to replace the ogalla aquifer water when it gets poisoned when the pipeline breaks

It is utter foolishness to expend any more time, effort and environmental sacrifice to fossil fuel, assets which need to be invested in developing a clean energy technology. If we continue to deplete existing fossil fuels, we will be forced to turn to solar energy, the supply of which will most likely outlive the human species. Making the conversion now, rather than later, will provide us a cleaner and healthier environment to enjoy now and for future generations,who will thank us for it, to enjoy as well.

For S.Comstock:

Google Port Arthur, Texas – foreign trade zone.

I understand that there is a FTZ in Port Arthur. There are multiple ones in just about every state of the country. My question is why would it matter that Canadian crude is moving through and processed in an FTZ when there is no duty on Canadian crude to begin with because of NAFTA? Canadian crude entering the US into a FTZ or non-FTZ area would have the same customs duty imposed – $0. So I was just trying to understand the point around a FTZ in this instance or what specific taxes were being evaded?

For S.Comstock: The state and sales tax on machinery and equipment, building materials, labor for rehabilitation of existing buildings and on electricity and gasoline for use in the zone. No customs duty on non-Canadian, foreign products used in the Zone and no quota limits.

S. Comstock – good questions and I know some more detailed answers are headed your way soon. Two quick things. First, on do we know that they have all taken the 179C deduction – we think it’s completely reasonable to assume that an oil company will do its fiduciary duty to its shareholders and maximize its profits at every possible turn. They are in fact very good at that. If Motiva, Valero, or Total would like to make their full returns publicly available we’d be happy to be corrected if need be.

Re: FTZs – don’t take it from me, take it from the National Association of Foreign Trade Zones in this piece co-authored with ExxonMobil:

http://www.naftz.org/resource/collection/EFD869A5-F2E9-4FC4-AC9C-845C677C70D4/Why_Zones_are_Important_to_the_Oil_Refining_Business.pdf

S.Comstock. Thanks for your interesting questions.

Many of the IRS MACRS asset classes provide subsidies to capital formation relative to actual service life of the assets. For example, asset class 13.3 for refineries, to which you refer, allows long-lived refinery assets to be written off from taxes in only 10 years. These assets are also allowed to use the most accelerated depreciation method within those 10 years (the 200% declining balance method) to further push the deductions to the early years. These rules, like the even more accelerated refinery expensing under 179C, are most likely the result of concerted lobbying efforts by the respective industries; they are not true measures of the economic life of the assets.

The question you raised was why not use the 10 year/200% declining balance depreciation as the benchmark from which to estimate the subsidy value of the newer expensing allowance under 179C. It really depends on what question you are trying to answer. From the industry’s perspective, they would want to look at the incremental benefit of the 179C subsidy relative to their baseline subsidized depreciation schedule, as that best measures the subsidy gains from their lobbying effort.

However, in looking at market distortions it is most useful to compare 179C to a service life baseline, not a subsidized baseline. This is because oil competes both against other fuels and with demand-side options and improved efficiency, so isolating the calculation to a politically-established subsidized baseline is not adequate. As noted in the piece, we expect the service life of these assets to be longer than the 30-year period we’ve assumed in our upper bound. Cost of capital and marginal tax rate assumptions were also conservative, suggesting our numbers are likely to be lower than the benefits the refineries will actually receive.

We are still evaluating the impact of the FTZ designation on the economics of the sector, and of this pipeline specifically. The FTZ issue was not a factor in the subsidy numbers released yesterday. However, the destination of the oil going through the pipeline is clearly relevant politically, since refinery subsidies have been justified on energy and national security grounds.

While it is conceivable that the refinery projects will not use 179C depreciation, we are not privy to internal project documents to exhaustively evaluate this issue. However, we consider the likelihood of them not using the provision remote for three of reasons. First, pressure from the industry since 2005 has resulted in expanded eligibility to tar sands refining and an extended window for project eligibility. This would not have happened unless these types of refineries plan to use the tax break. Second, at least at present, all of the projects are slated to meet the law’s timelines. Third, the benefits from 179C, even relative to the MACRS schedule, are sufficiently high that project managers will work hard either to meet the deadline or to have it extended again so they can partake.

Thanks so much for the responses. It has been helpful.

I was reading your original post as stating that the 179C deduction was driving the investment. When I calculated the difference between MACRS and MACRS plus 179C, I assumed that is how a company would look at it and I only got a difference of around $3.3 for every $100 of investment using a 6% discount. It did not seem like alot and probably swamped by the raw crude price presented by the Canadian supply. I was also hesitant to assume that using MACRS was a subsidy for capital. While I am not sure what the lobbying activity was in the early 80s when these asset classes were set, the 10 year life afforded refining is not all that great compared to other capital investments (like chemical plants). If one assumes that all eligible taxpayers would use MACRS (including refining) there are a lot better returns generated by MACRS out there for your marginal investment dollar. So I was looking at the impact 179C would have on that return calculation versus other marginal returns on capital.

On the issue of whether the companies are eligible for the benefit, I was not concerned at the timing of the investment but whether you had any clarity that the investments met the expansion threshholds in the provision. I also think it is tricky to assume what US subsidiaries of foreign parents are doing for US taxes. I understand the basis for your assumption, I just did not know if you knew they would qualify under the statute.

Finally, on the FTZ, based upon the reading directed, it appears to be beneficial when there is a duty on the raw material. Since NAFTA precludes a duty on the Canadian origin crude, I was confused on the relevance of the FTZ comment you included and what duties are being avoided with the use of a FTZ in this instance. Clearly it is a different case if one is talking about Venezuelan crude where duty applies. It also looks like alot of refineries in the Gulf Coast, West Coast, MidWest and East Coast have FTZ. Again, such designation does not seem relevant with NAFTA origin crude, but I was wondering if so many refineries have them why “the destination of the oil going through the pipeline is clearly relevant politically”. Is this real issue the potential for exporting product, which could arise regardless of which refinery the crude goes to and seems distinct from the FTZ point?

You are just talking about the taxes on the cost of the equipment, not the entire cost. Why should we make them pay taxes on it, it just ends up costing us more for refined products in the end? We, the consumer, pay all taxes. Corporations should pay no federal taxes since it is all just passed on in the cost of the product. The federal government collects more in taxes from the oil companies than they make in profit. What the hell is fair about that anyhow?

There is no sales product tax on petroleum passing through XL because the terminal is in a FTZ. Once this oil is in the FTZ and crosses the FTZ border to the US, there is a sales product tax, and there no tax, if exported. KXL will benefit the three refiners in Port Arthur,only.

E. Richards,

I appreciate the time and input provided by all on this. It is an interesting discussion. With respect to the “sales product tax”, is that in reference to the federal (and state) motor fuel taxes on gasoline and diesel? It is my understanding that the taxation point for those are after the refining and not until the product has been transferred over a terminal rack into a distribution truck. Of course, if the product is exported then there would be no tax since the product was not sold into the US retail system. However, this, again, has nothing to do with the FTZ designation – just where the refined product is sold. In other words, if domestic crude was refined into diesel and exported, it would also not incur the excise taxes. I think that to try and apply one would be unconstitutional under a case that looked at these types of things. Maybe it is just a question of what is meant by “sales product tax”.

Mr. Comstock. Seeing as you are the American Petroleum Institute’s Tax Policy Manager it’s clear you understand very well what’s going on. In the interests of transparency we welcome your comments but would have preferred you being honest about your position. Clearly you know how these tax codes have been implemented and how much tax companies have avoided through them so please feel free to furnish us with some concrete figures. Thank you for your comments.

For Mr. Comstock:

Ref: sales product tax

Google: “Keystone XL Benefits from Taxpayers Subsidies.”

Mr. Stockman,

I genuinely apologize for any misrepresentation. I was not really acting in my capacity with API but interested in the points you made. I thought that I had tried to keep the discussion open and respectful of the different views. One can quibble with the different approaches but I don’t have any concrete information on company positions either. I had heard that some were concerned as to whether they could qualify for 179C because of the threshold requirements, but I also understood your assumption in how it might be pursued or taken. I was and still am interested in the FTZ point with respect to KXL. I just don’t see why FTZ matters and have not seen much that clarifies that point. I was hoping to explore that through this discussion.

Regardless, I apologize again for any perceived antagonism on my end. I do appreciate the chance for the dialogue and thank you for your comments and responses.

Busted

According to a Canadian Broadcasting Company report, China has invested $15B in the Canadian oil sands development. So the XL pipeline project will move Chinese-owned oil through the U.S to be exported to the highest dollar offered. How does that benefit the U.S?

PLEASE DO NOT SUPPORT THIS PIPELINE PROJECT . IT IS ONLY FOR THE PROFIT FOR BIG OIL , A MAJOR POISON and POLLUTION ISSUE FOR US , and NO USE FOR THE AMERICAN PEOPLE !!!!!!!

This project is completely wrong for this country on so many levels. Sadly, many Americans are clueless to this environmental hijack. When I mentioned it in my classroom, not one student had heard of it. Someone better start running television and computer ads about this and do it soon. We have it coming from all directions: devalued homes from abuses in the mortgage industry, folding small businesses from Wall Street abuses, and clean air and clean water contamination from old, out dated oil and coal industry. These greedy people better start doing what’s right for posterity instead of what’s profitable for a few.

The main subsidy for oil and it’s many byproducts comes from the people who purchase those byproducts. If you really are against drilling, oil spills, and related negative environmental impact, don’t buy oil.

Looks to me like your getting $10.5 Billion in new capital expenditures at the refineries. Which should generate many construction jobs. Increased production at the refineries will be more new jobs. A Canadian oil source could reduce our dependence on foreign oils.

There is a huge difference between tax breaks and subsidies but as everyone here already hates oil….

Let’s review. Tax break = paying less on income earned. Almost guaranteed return from jobs and product. Think Keystone

Subsidies = Take government cash and give it to a corporation, that may or not deliver. Think Solyanda

Alternate energy for things like transportation is still over 50 years away. In the meantime Obama and his cronies are continuing to weaken our country. There should be plenty of room for exploring *both* technologies.

What really makes me sick is that the Republican leadership is using the artificial spike in gasoline prices as a way to attack President Obama. If Solyanda had not decided to shut down two of its refineries and threaten to shut down a third, and if the republican Congress would allow time to study the environmental impact that building the Canadian pipeline right through the heartland of the United States or have we forgotten the BP Gulf oil spill already?, and if Obama was God and could control international events, then the republicans might have an argument. But to lay this at the feet of the President is just dirty street fighting because the republicans have no candidate who can beat Obama in the next election. This is the republicans and big oil putting a frail economy at further risk by manipulating the price of gasoline and trying to blame Obama for it. And to the person who said that alternative energy is 50 years away, I have solar panels on my roof that save me 300. dollars a month. And I drive a Prius and spend sixty dollars on gas in an entire month. The technology is here now, government just has to start pushing it. In a way, this lame attempt by the Republican leadership to raise the price of gasoline will only help Obama in the long run as it will underscore the need for fuel efficiency and already existing forms of alternative energy.

and we will still have high gas prices We give them the gold mine and we get the shaft.

Mr. Stockman: Yes, Now Follow the Money

From Valero Oil’s 2010 Annual Report: “The large hydrocracker projects at Port Arthur and St. Charles, due for completion during the second half of 2012, should create high-value products […], and the Port Arthur project additionally will include facilities that are projected to process more than 150,000 barrels per day of high-acid, heavy sour Canadian crude.”

Do you suppose they’re worried there won’t be a pipeline to feed their expansion? During the first half of Year 2011, the Valero Energy Corporation PAC reported 114 political contributions totaling $339,850, of which six contributions totaling $13,500 went to organizations or campaigns of political affiliation “D,” 41 for $58,250 to those affiliated “NP,” and 67 contributions totaling $268,100 to those of political affiliation “R.” The R group included the Republican Governors’ Association ($25,000), National Republican Congressional and Senatorial Committees ($15,000 each), and 33 individual republican campaigns for US Representative or Senator ($108,000). The D group included five contributions of $2,500 or less to state campaigns in California and Texas. In what was the Valero PAC investing?

Here next from Valero’s Annual Report: “The units should generate liquid volume expansions of 25 percent to 30 percent. The main products will be high-quality diesel and jet fuel to meet growing global demand for middle distillates.” Between Years 2001 and 2009, US jet fuel consumption decreased by 5%, while it increased in Brazil, China and India by a combined 46%. During the same period, US consumption of diesel declined by 4.5%, yet increased in Brazil, China and India by a combined 37%. Where could Valero be considering selling?

Keystone XL will enable around 3,000 (mostly already on staff) employees across three refineries in Port Arthur, TX (Motiva owned by the Dutch and the Saudis, Total a French company … and Valero run by good, ol’ Texans) to process Canadian oil and ship it to Asia and South America.

Dylan’s on 9th in Port Arthur and similar surrounding support services will be thrilled. I don’t know that many more Americans will see profit … unless we happen to be members of Congress.

SEE[media.valero.com/flash/AnnualReport2010/pdf/report.pdf]

SEE[valero.com/Financial%20Documents/VALPAC%20Contributions%20January%20-%20June%202011.pdf]

SEE[eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=5&aid=2&cid=IN,&syid=2001&eyid=2009&unit=TBPD]

Who benefits by shutting down East Coast refineries like Marcus Hook and Trainer?

Normally, increase in supply produces a lowering of costs be it guns or roses. Seemingly, this issue has become a two headed snake. Kill it to save the environment and stop the use of taxpayer subsidies or ride it through to a probable lowering of gas prices throughout the US.

Let me specify some arguments I’ve seen:

FOR:

1. More gas, lower prices

2. More jobs, this relates to about a few hundred permanent jobs on the pipeline but thousands during construction.

3. Somewhat of 2. continued refineries will have more work. Also, subsidies have already been used to help outfit these factories so stopping now will be a much greater depreciation of value.

4. Might help relations with Canada as they appear to be straining with this president.

5. The equipment in refineries allows imported crude oil to be taken in also and can create much more usable fuel.

AGAINST:

1. This oil will be exported, that depends on the refineries, not the pipeline. Many might be offended, but if it’s in the best interest of these companies why fight them? It would suck but that’s more money for them to invest in green tech.

2. It’s not green tech, well green tech is “holy cow” expensive as we’ve seen in solyndra and other solar companies. Give it time and new energy should be produced I’d believe. If you feel for it to an extent, you research it!

3. The environment will suffer, it’s on land. Land would mean leakage would be contained to a smaller area. I’d assume there would be a shut off as well. With EPA the way it is, though, a spill would be unlikely.

4. I hate oil, tough noogies.

5.Taxpayer money involved, yes there is. I’m sorry, but now it’s invested and the only way to get your money back is to let the oil river flow. (in the pipe I mean)

6. THE TAXES ARE NONEXISTANT! Blame the tax code. People are trying to make it transparent which would cull sneaky tax exemptions.

If you disagree with a better argument please share. I wish to learn more, but this pro’s and con’s was what I have learned through researching many people’s opinions and figures. As a result, I may be mistaken.

Earl Richards writes: “The refiners do not have to pay any taxes and custom duties on the importing and exporting of petroleum products.”

No refiner anywhere — FTZ or not — pays custom duties on importing or exporting of petroleum products. There are no duties that apply, which is exactly the same case with most everything else we export. But, the refiners do pay income taxes on income they earn from exporting finished products.

If you really think this is an FTZ issue, point me to one refinery in the U.S. that must pay any additional duties or taxes on exported products.

People may not realize it, but this oil is already coming into the U.S. via rail, truck, and existing pipeline. Stopping the pipeline will do exactly zero to stop the growth of the oil sands — which has been growing rapidly in recent years.

Gentlemen, What benefit will myself and my family get from the Keystone Pipeline? Will gas prices at the pump go down/ Will we receive reduced taxes? Yhank you.

If this does go throug all the states it goes through should get a use tax for this pipe to go through their state. It would be shared with all citizens of that state. Like Alaska does

RPB, your statement “Alternate energy for things like transportation is still over 50 years away. In the meantime Obama and his cronies are continuing to weaken our country. There should be plenty of room for exploring *both* technologies.” is wrong on at least two points. I doubt that it will even take 50 years for alternate energy sources or technologies to become a respectable percentage of transportation energy use. Look at the increasing use of hybrids and electric vehicles. Manufacturers are already starting to sell fuel cell equipped vehicles to the public. The problems is fossil fuels has a monopoly on energy subsidies and would like to keep it that way. The amount spent on alternate energy sources is small compared to fossil fuels and while fossil fuel consumption is not required to pay for it’s true life cycle costs it will continue to dominate the energy supply lines. Why not just build refineries up in Canada and not worry about a pipeline if the US is supposedly going to benefit from all of this oil? I suspect the vast majority of oil and its products will be going to developing countries over the long term, not the US.

The truth is this: ANY Capital investment is treated the same as the pipeline is and it is NOT a “subsidy” as the author here wants you to believe. A single hospital, for example, could decide to build a multi-million dollar abortion wing with state of the art equipment to insure that they could quickly process hundreds of abortions a day. They would be able to use EXACTLY the same accelerated depreciation that is being touted as a “subsidy” by this author, who is either ignorant, or deliberately misleading people — making lies of the same magnitude that he is accusing politicians as. Lorne Stockman has an agenda, and is willing to twist the truth if he thinks it can benefit his cause. I have no respect for such a hack!

Tax write-offs for plant modernization, tax allowances for depreciation, and other earnings balances in the US corporate tax code are not subsidies by any stretch of the imagination, unless you believe that all earnings belong to the government first, and whatever it doesn’t confiscate is somehow a government earnings loss! The best way to avoid even the appearance of “subsidy” by corporate tax write-offs would be by totally eliminating the corporate income tax, which is just an indirect theft from consumers of corporate products. Zero corporate tax–now that would be logical and fair!

“Both Sides” is right. Tax breaks are not subsidies. A zero corporate tax is absolutely logical. Corporations should pay fees for the government services they actually rely on – local police and fire departments, road use, etc. America’s governments kill productivity and progress toward reducing poverty by treating businesses as cash cows. Profit is a good thing, the natural result of using resources wisely – the last thing we should discourage by levying taxes. Same idea applies to human labor – very dumb to tax it.

IF the pipeline can NOT be built and run without government subsidies, then it should NOT be built or ran. IF you can NOT support your business without government, then you should’t be in business.

BUT, from what this article says these companies are NOT getting taxpayer funded subsidies. The article is wrong in saying that tax breaks are subsidies. Tax breaks are reductions in your tax burden not subsidies. A subsidy is a sum of money (not tax breaks) granted by the government or a public body to assist an industry or business so that the price of a commodity or service may remain low or competitive. Its free money belonging to others, NOT getting your own money back.

It also says these tax breaks are the equivalent to a loan to the oil companies. No its a tax break. This article is either purposefully putting out lying propaganda or the author is ignorant of what subsidies are.