Our latest report released today exposes U.S. oil producers that want to export crude oil despite the fact that they still only produce barely more than 50% of U.S. oil demand. 40 years on from the Arab oil embargo and America’s oil producers have only one thing on their minds; profits.

Our latest report released today exposes U.S. oil producers that want to export crude oil despite the fact that they still only produce barely more than 50% of U.S. oil demand. 40 years on from the Arab oil embargo and America’s oil producers have only one thing on their minds; profits.

Lifting crude export restrictions would bring U.S. oil prices in line with international prices and enable oil producers to charge U.S. refiners more. This is the focus of increasing calls from the industry and its investors for an end to crude oil export restrictions.

The U.S. oil boom is based on hydraulic fracturing (fracking), an intensive and expensive drilling method that has unlocked billions of barrels of formerly inaccessible oil in North Dakota, Texas and elsewhere. But increasing production depends on drilling thousands of wells as well productivity typically declines over 60% in the first year. Drillers need higher prices to keep drilling in ever more marginal locations and without exports U.S. crude oil prices may not support this.

The price increase that exports would enable will allow drillers to open up new reserves and herein lays the problem. We can’t afford to burn the reserves we already have, so any policy that enables the oil industry to exploit more reserves is a recipe for disaster.

The Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) agree that if we are to prevent climate change from breaching the already severe 2 degrees Celsius (3.6oF) level then we must leave at least two-thirds of current proven fossil fuel reserves in the ground. We calculate that, depending on how much coal consumption can be curtailed, this means that only 20-25% of current proven oil reserves can be exploited.

The motivation behind industry calls for deregulated crude oil exports is to enable development of so far undeveloped oil reserves. This would add to oil reserves that we already cannot fully consume without destroying the climate. This added production would not enhance U.S. energy security or reduce energy prices, it is intended to raise prices and serve international markets.

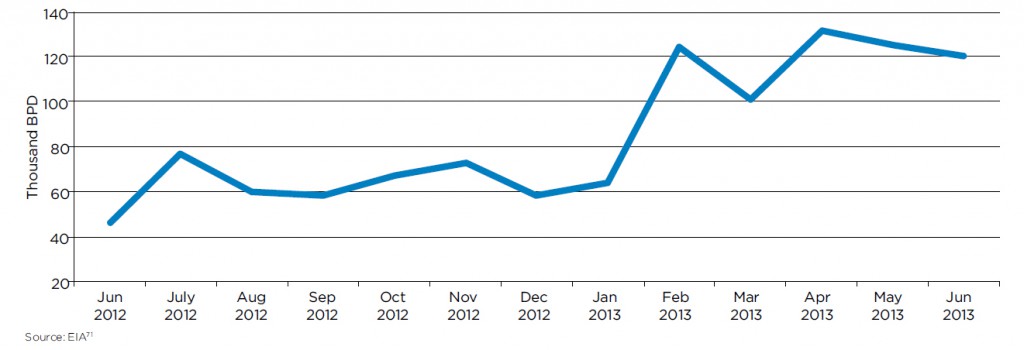

Current export regulations, in place since the 1970s Arab oil embargo, only allow exports to Canada. These shot up this year, doubling since January (see Figure below).

U.S. crude oil exports to Canada June 2012-June 2013

Exports of refined products, such as gasoline and diesel, have been soaring for several years now, reaching a new high of nearly 3.8 million barrels per day in July. Since 2007, these exports have risen over 130% with the main customers being in Latin America and Europe.

But crude producers want a piece of this action too and they are increasingly making their voices heard in Washington. Free market think thanks such as the Cato Institute have called for an end to all restrictions on energy exports, while the Council for Foreign Relations issued a ‘Policy Innovation Memorandum’ recommending an end to crude oil export restrictions. They cite “industry executives” eyeing upwards of $15 billion in annual export revenues by 2017.

But much of this discussion is going on behind closed doors. We are yet to see a very public push from the industry because the issue of oil exports is highly sensitive. Why? Because America still imports some 8 million barrels of oil per day and rising production is unlikely to make a real dent in that. In fact, despite the biggest oil boom since Spindletop, the U.S. remains as vulnerable to global oil price spikes today as it did back in 2008 when prices peaked at nearly $150 a barrel.

40 years on from the OPEC oil embargo that saw fuel shortages across America, the U.S. is ranked fifth most vulnerable country in terms of oil security in a report released Monday by energy security experts. This is because America still consumes more oil than it produces and is among the highest per capita oil users in the world. There is little end in sight to this situation especially given the U.S. oil industry’s grip on Washington policy making.

The push by the oil industry and its supporters to make America an oil exporter before an international regime is in place to limit climate change, should be seen for what it is; an attempt to grab the money and run leaving a legacy of destruction and disaster in its wake.

Without an effective regime in place to limit greenhouse gas emissions globally, deregulating U.S. crude oil exports can only exacerbate an already critical global climate crisis. The United States should not export its crude oil but should instead play a leading role in international efforts to keep fossil fuels in the ground.

no comment.

Seems to me that a carbon tax would also bring U.S. oil prices in line with international prices. More importantly, it would increase support for non-fuel energy options and encourage more fossil fuels to be left in the ground for future generations.

The US is not vulnerable to international oil spikes, because the IntercontinentalExchange (ICE) in Atlanta controls and manipulates both the Brent price and the WTI price. Google the “$2.5 Trillion Oil Scam – slideshare” and Google “Goldman”s, Global Oil Scam.” The US oil imports would be priced on the Brent benchmark, and ICE in Atlanta controls and manipulates the imported Brent oil price through its subsidiary, ICE Futures Europe in London. ICE has control of the oil price as far away as Singapore, because the Singapore spot market uses the Brent benchmark.

Oil exports would increase the price of oil & products in the USA which would reduce consumption. If you are worried about climate change, I suggest a tax on gasoline is better for everyone than trying to restrict trade.

The U.S. is ranked the fifth most SECURE nation, not vulnerable according to that link. Learn how to read your own sources please.