Published by Oil Change International.

Endorsed by Action Center on Race & the Economy (ACRE), Alberta Liability Disclosure Project, Amazon Watch, APMDD, BankTrack, Bold Alliance, BothENDS, Campax, CAN-RAC Canada, Canadian Centre for Policy Alternatives, Center for International Environmental Law, Climate Emergency Unit, Collectif Break Free, Conservation Council of New Brunswick, Culture Unstained, David Suzuki Foundation, Democracy Collaborative, Earthworks, Environmental Defence Canada, Équiterre, Fossil Free Media, Friends of the Earth US, Global Witness, Greenpeace US, Health of Mother Earth Foundation, Indigenous Environmental Network, Laudato Si’ Movement, Les Amis de la Terre France, Milieudefensie, Positive Money, Power Shift Africa, Public Citizen, Rainforest Action Network, Reclaim Alberta, Reclaim Finance, Reclame Fossielvrij, ReCommon, Recourse, SHIFT Canada, Social Tipping Point Coalitie, SOMO, Stand.earth, urgewald, Women’s Earth & Climate Action Network, 350.org..

May 2022

Never before has the case for keeping oil, fossil gas, and coal in the ground been stronger. And despite an array of new ‘net zero’ pledges released in the past two years, the climate promises of major U.S. and European oil and gas companies still fail to meet the bare minimum for alignment with the Paris Agreement.

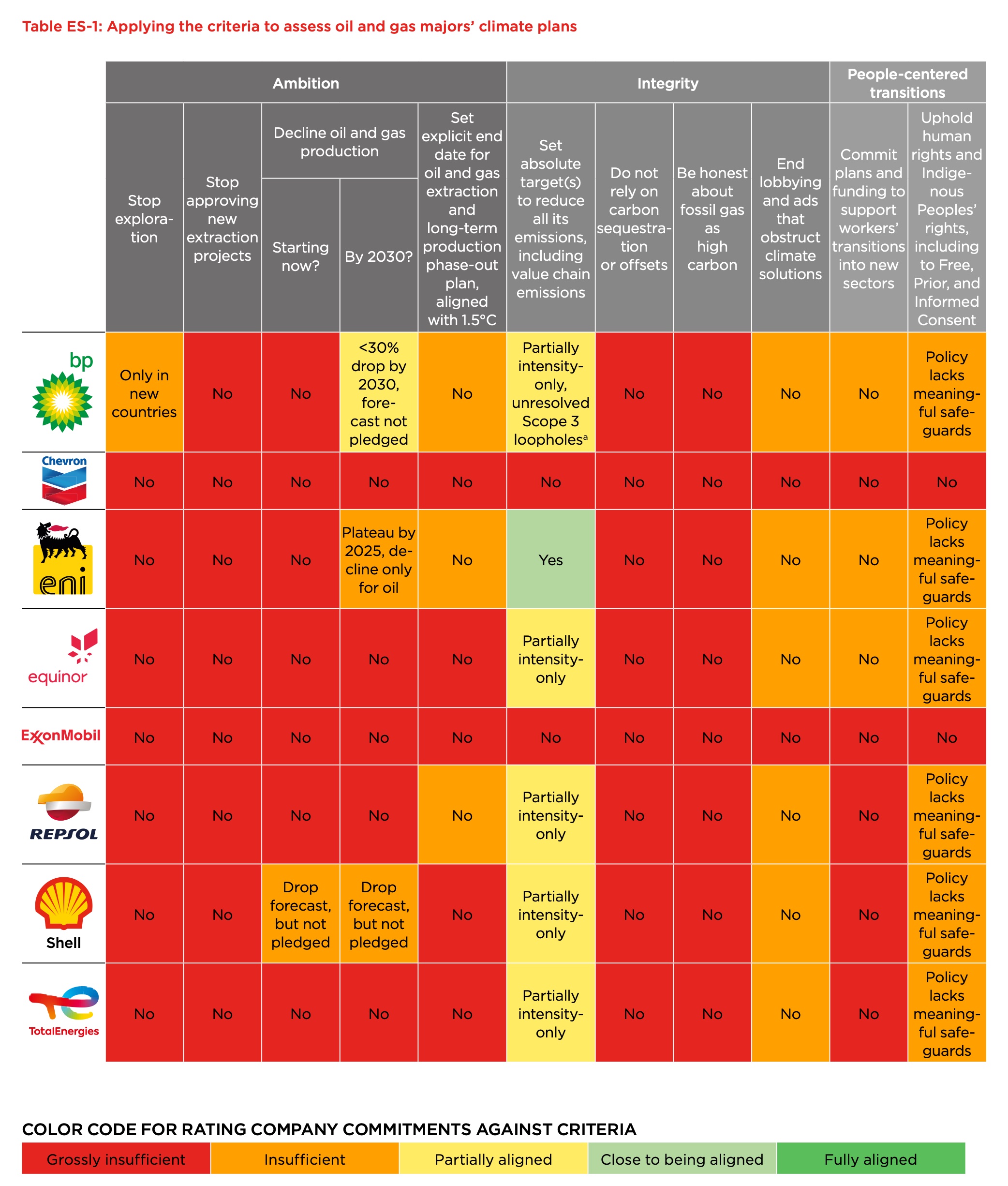

This report, titled “Big Oil Reality Check,” is an update from an inaugural 2020 study which analyzed the latest climate pledges of BP, Chevron, Eni, Equinor, ExxonMobil, Repsol, Shell, and TotalEnergies against 10 minimum benchmarks for alignment with the 1.5°C temperature goal outlined in the Paris Agreement. We reveal that these eight oil and gas companies alone are involved in over 200 expansion projects on track for approval from 2022 through 2025 — equivalent to the lifetime emissions of 77 new coal power plants.

Our analysis shows that all eight of these companies’ climate pledges and plans are grossly insufficient. Chevron and ExxonMobil are assessed as grossly insufficient on all criteria.

Ultimately, no major oil and gas company considered in this analysis comes anywhere close to the bare minimum for alignment with the Paris Agreement. The companies that have collectively done the most to fuel the climate crisis cannot be trusted to confront it meaningfully. Both public- and private-sector decision-makers must take action both to destroy the demand for fossil fuels and to choke off their production. Governments and the financial sector each have key roles to play.

I agree with the authors! The Big Oil Companies are not doing enough, yet they are at the forefront of the production of fossil fuels, their processing, and the subsequent delivery to the markets. I think one of the problems is that the governments in which these companies have headquarters have turned a blind eye to the activities of these Big Oils. Unfortunately, the actions of these companies have global coverage, meaning the impact is geographically covering the rich, emerging, and developing countries. On the other hand, most Big Oil Companies have their headquarters in the developed countries from where they operate and spread to the developing countries. Time and again, these companies are almost untouchables in the developing world, yet the same companies can be dragged to Courts of Law in their home countries. At the moment, there is a significant pipeline project being constructed, or have they started, which will run for several kilometers from Dar es Salaam to Uganda. When asked by media and the public whether or not France would finance the oil pipeline in the East African countries between Tanzania and Uganda, the French President, Emmanuel Macron, was clear that he would not ‘interfere’ in the sovereign matters of other countries! However, the big question remains: from which country do the companies involved in constructing the pipeline? The global energy dynamics are ambiguous and vague, always influenced and dictated by the global geostrategic and geopolitical interests.

In its effort to fight climate change, the International Energy Agency (IEA), in May 2021, resolved that there would be no more investment in fossil energy in all its member countries. It is a commonplace that most Big Oil companies are from the IEA member countries. How feasible and practical it is to enforce this resolution remains a dilemma.

All said, from a worldwide energy diplomatic perspective, the negotiations and bargaining is an ongoing process and a work in progress. I also think developing countries whose development and industrial dreams lie in the recent discovery of fossil energy resources should be substantially assisted in adopting clean, modern, and climate-friendly energy sources. Possibly, this avenue can convince the governments in these countries that are struggling amidst a trilemma of poverty, Agenda 2030, and climate change.

By refusing to fund the pipeline, France would not be interfering in the sovereign, internal affairs of any African country; any more than by refusing to pay for abortion, any taxpayers or legislators are somehow violating anyone’s privacy or “right to control her own body.” Macron’s argument is invalid.

This is a heart breaking read! What can be done to force these large Companies to stop ignoring Climate Change, which WILL destroy our one Earth forever. They must realize the insanity of what they are doing to the Earth, and murdering Human and Animal Life, including their own families!!!

I hear the yahoos around me complaining of $5 per gallon Diesel fuel. They still blame the Biden administration for lack of fuel, not the oil and gas companies that own the entire distribution complex as well as Duke. My electric co-op continues to push the need for more oil.

Around $20 billion annually in subsidies to fossil fuel corporations in the U.S. Canada’s government is also very generous to its fossil fuel polluters.

Enough is enough. Oil and Gas Companies are failing me, you, my children and your children.

A key US action to slow fossil fuel infrastructure investment is to institute a socially just carbon tax with a border carbon adjustment.

If the tax rose sufficiently over time, and were politically durable, then banks would be very unlikely to risk lending to long-term fossil fuel infrastructure projects.

Here’s how a socially just carbon tax with a border carbon adjustment would achieve that outcome.

The tax would be applied to the carbon content of fossil fuels before they enter the domestic US wholesale market. It would be paid by the producers or importers of the fuels. The carbon tax would rise annually. It wouldn’t be applied mid-market, as it is in CA’s and the EU’s cap-and-trade system; nor would it be a consumer surtax. To work optimally, the fossil fuel companies must own the tax and thereby be compelled to determine how much of it to pass along, as they do with any other tax or other business expense.

An ever-rising tax applied at the source of the fuels would reach into all areas of the economy. It would reduce demand steadily and predictably, particularly in the business sector, which would squeeze carbon out of its upstream processes and supply chains to remain economically competitive. Consumers would also become carbon-conscious because, over time, low-carbon goods and services will tend to be cheaper.

The proceeds from the tax collected from the fossil fuel companies would be returned to all individuals in equal shares. Returning the proceeds this way accomplishes four critical goals for driving carbon emissions to zero in the next 25-30 years:

1. It makes the program politically popular and durable, similar to Social Security, so that banks and businesses can rely on ongoing reductions in demand to make multi-year strategic plans that would necessitate investments in switching to clean energy sources.

2. It protects low- and middle-income individuals from inevitable cost increases in high-carbon goods and services until businesses can implement lower-carbon processes and designs. For example, it would protect them from rising fuel prices for currently-owned internal-combustion vehicles and in-place home heating, until the market provided a greater array of cheaper electric vehicles, and existing oil and gas furnaces and water heaters reached the end of their functional lives, to be replaced by heat high-efficiency pumps.

3. It provides an incentive for all consumers to maximize the difference between their equal-share rebate and the cost of the goods and services they buy, which will feed a virtuous cycle of further carbon reductions. Consumers can earn money simply by value-shopping as carbon-intensive goods and services become increasingly expensive, and low-carbon ones increasingly cheaper. This retained income isn’t “free money”; it is earned through diligence and wise personal finance management.

4. It avoids special-interest infighting and the possibility of class resentment based on perceptions that some individual or groups are favored. This is a key driver of the ongoing success of Social Security, and an important lesson to be taken from it.

The border carbon adjustment (BCA) is a tariff that would be applied to bulk commodities such as oil, natural gas, cement, steel, and paper, but only from those countries that lacked a domestic carbon price equivalent to the US’s. This would protect American domestic business from being poached by overseas free riders flooding the market with high-carbon but low-priced commodities. It would also prevent American companies from relocating operations overseas to no- or low-carbon-tax countries to avoid the tax in the US.

There would also be a provision for a carbon tax credit for US companies that exported US-made goods to no- or low-tax countries, so that they weren’t competitively disadvantaged in those countries.

In such an environment of predictable decarbonization, banks would be very leery of lending to build pipelines, oil and gas fields, import/export terminals, and tankers. Why? Because the risk of loan repayment would be too high, since sales/utilization projections for those projects would show a steep downward slope toward zero.

The reluctance of banks to finance large fossil fuel infrastructure would further accelerate a virtuous cycle of carbon reductions.

What a shame! It is revolting, that the companies which made so huge money impacting the climate and contributing so strongly to the climate disaster, are not able to use their dirty money to save the humanity and the living world. They must be so reach that they hate their children. Let’s force them to act. It’s the last moment for all of us.

While there is demand for energy there will always be someone willing to supply energy.

For the planet to reach the 1.5°C target – which is absolutely essential – we must all significantly reduce energy demand.

Removing fossil fuels is a nice idea BUT it will only work if there is an alternative supply of energy available to meet the demand. That (non-fossil-fuel) alternative supply of energy is currently not available in sufficient quantity.

To be credible in the climate debate you must demonstrate a credible pathway for alternative energy sources. If fossil fuels are run-down without replacing the energy from other sources then there will be significant challenges for us as people who are used to having energy immediately available.

In the meantime, if we all start to follow the IEA 10-point plan for reducing energy then that will be a good start.