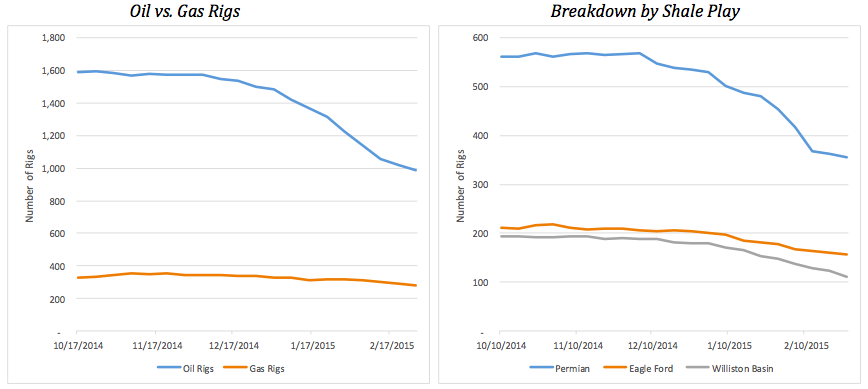

Oil and gas companies have responded to the dramatic fall in oil prices over the past few months by idling drilling rigs. Since last year’s peak rig count, the total count of operational U.S. oil rigs fell by 38.7%, from 1,609 on October 10, 2014 to 986 as of February 27, 2015.

U.S. Rig Counts

Source: Bloomberg Professional (Feb. 2015)

Tight oil production is particularly responsive to changes in oil price, as it is relatively easy for producers to start and stop rig operations (in comparison to production from other oil resources such as tar sands or deepwater). But as Steve LeVine points out the productivity of the rigs still in play may be going up as producers concentrate their activity in the richest plays. Rig counts in the three largest U.S. oil shale plays (Permian, Eagle Ford, and the Williston Basin which includes North Dakota’s Bakken formation) dropped by 26% to 43% depending on the play, together accounting for a decline of 344 operational rigs since October. However, a commensurate drop in production, and therefore a recovery in the price of oil, still appears a long way off.