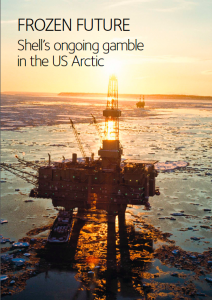

Frozen Future: Shell’s Ongoing Gamble in the US Arctic

Frozen Future: Shell’s Ongoing Gamble in the US Arctic

Oil Change International, Greenpeace, Oceana, Platform, Pacific Environment, and ShareAction

February 2014

‘Frozen Future’ warns investors of the risks to shareholder value from Royal Dutch Shell’s Alaskan Arctic drilling program.

Operational failures, public pressure and legal challenges forced Shell to abandon its 2012, 2013 and 2014 US Arctic drilling programs but the company still remains committed, at least publicly, to the region.

Other oil majors – Statoil, Conoco-Philips and Total– have all stepped back from drilling for oil in US Arctic waters – largely at the project level – for reasons of cost, as well as regulatory uncertainty. Total has announced that it would not drill for oil at all in the Arctic Ocean due to the reputational risk of any spill in the region.

Despite spending over £5 billion in the US Arctic Ocean so far – a figure that dwarves the expenditure of other oil majors – Shell has failed to drill for oil there.. Shell’s capital investment in 2013 is at a record high, while at the same time, the company has recorded a steep drop in profits. Shell appears ready to ignore the economic, legal, operational, regulatory, reputational, and environmental risks of the Arctic, all detailed in the report, in pursuit of highly uncertain returns. ‘Frozen Future’ argues that shareholders should analyze whether the high cost, high risk US Arctic Ocean represents an appropriate allocation of shareholder capital.

The report explores a number of operational and economic risks facing Shell from offshore US Arctic drilling including:

- the company acknowledges that only an oil find could make the project profitable, but US government data suggests that Shell’s prospect is a gas not an oil play;

- a long-term, capital intensive project dependent on high oil prices beyond 2030;

- inadequate oil spill response infrastructure in a remote region;

- concerns over contractor management;

- the lack of disclosure of Shell’s estimate of and preparedness for the financial impacts of a worst case scenario spill;

- ongoing litigation; and

- regulatory uncertainty.

Help me understand, how an oil company can decide how, and where, naturel resources can be sold. These resources belong to the American public, Hence, the term “public utilities”.

Q