The conclusion of an article in the Financial Times the other day was that there was only one way to explain three recent major bets by Royal Dutch Shell, including its 7 billion dollar bet (and counting) on Arctic Oil: the company must know something we don’t because objectively these plays don’t make a lot of sense.

There is a different explanation, one that doesn’t require the same leap of faith that was required in believing that big banks knew something the rest of the world didn’t in the lead up to the global financial crises in 2009. And that is that desperate times call for desperate measures.

If the ‘cautious’ Shell (as the FT piece pegs them) is ready to scramble for these high cost, high risk plays – the more likely explanation is that times are getting a whole lot tougher for Big Oil.

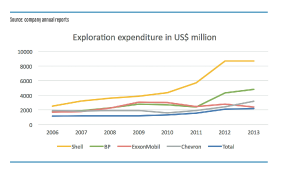

Our analysis shows that exploration costs are climbing for all of the majors and have been for at least a decade (see figure). Under pressure from investors, most companies have since cut back their expenditure, although levels remain considerably higher than before the growth of the last few years.

Shell leads the pack in exploration capital expenditures, with a significant portion going to its thus-far futile Arctic program.We know that companies have already tapped the lowest-hanging fruit when it comes to global oil reserves, and what is left are the higher-carbon, higher-cost, higher-risk reserves that companies are now scrambling for as they attempt to keep up with the reserves replacement that is so critical to their company value.

Shell has fought to recover from a reserves scandal that rocked the company over a decade ago, and is no doubt hoping to come up with some big finds to cushion its books. There are two ways it can do this, acquisition -the BG buy – and exploration – the Arctic program (the third big bet in the article is the partnership with Russian state-owned Gazprom).

But these bets are contingent on a lot of things, not the least of which is an assumption that global demand for oil will make these projects worth it. In other words, they are bets that we won’t make the necessary reductions in global fossil fuel demand needed to avoid the worst of dangerous climate change. They are a bet that we will fail.

This is why Shell’s Arctic program in particular has become a lightening rod for citizens concerned about climate change as study after study has shown that arctic oil is 100% unburnable in a climate safe world. The scientific reality that three quarters of the fossil fuel reserves that we already know about have to stay underground if we are going to avoid the worst of dangerous climate change – is taking exploration and expansion off the table.

So rather than assuming that Shell knows what no one else does – the answer may be much simpler than that: we are at the bottom of the barrel in more ways than one when it comes to oil in an era that will see the decline of fossil fuels.