Thanks to The Checks and Balances Project for this cross post and Headwaters Economics for the study.

Thanks to The Checks and Balances Project for this cross post and Headwaters Economics for the study.

When you fill up your tank for vacation this summer, keep in mind that the dial at the pump is spinning faster than you think. In addition to what you pay at the pump, your tax dollars are going to waste subsidizing oil companies.

As families pile into the station wagon to hit the road, Republican members of Congress are taking advantage of Americans, and the price at the pump, with their own tour to spin Big Oil talking points. They are avoiding the real conversation we should be having about energy. It’s time to end tax breaks to oil companies and reinvest those funds in American energy solutions such as transportation improvements, high tech vehicles, and the next generation of renewable fuels.

A new study from Headwaters Economics explains why taxpayer money is going to waste when we throw it at oil companies trying to encourage them to drill.

The evidence overwhelmingly suggests there are three things that drive oil production: geology, technology and price.

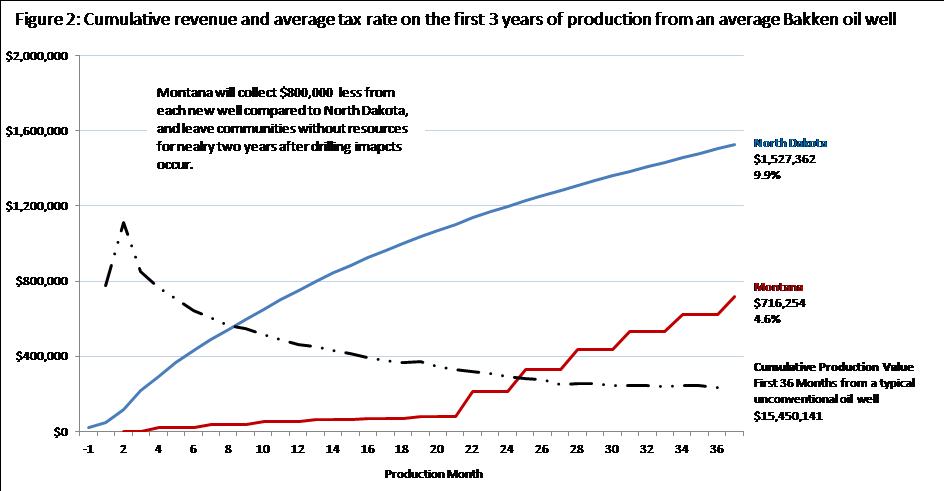

The study compares two neighboring states, North Dakota and Montana. Since the end of 2009, oil production has more than doubled in North Dakota while Montana’s production, where the tax rate is less than half, has declined by 14 percent.

This difference in production levels can be explained by a few simple factors, the first being that North Dakota has better conditions for drilling than Montana. Resource extraction is a location-dependent industry. ACME Widgets can open a factory just about anywhere and make widgets. ACME Drilling can only drill where there is oil. North Dakota has more oil, so it has more oil drilling.

Drilling isn’t solely limited by geology. Drilling in many locations is or isn’t profitable based on the technology available and the price of oil and natural gas on the market. The report found that a combination of high prices and the use of fracking contributed to a dramatic growth in domestic drilling starting in 2003. By 2008, a national recession and lower oil and gas prices led to a dramatic reduction in drilling.

Additionally, the report finds that production subsidies are late in the business cycle and don’t induce additional production. By the production stage, companies know where the oil is located, have determined if they have the right technology to extract the oil, secured leases and permits, and actually drilled a well.

So, if subsidizing oil doesn’t increase production, it’s not going to create jobs or lower gas prices.

Instead, subsidies are a burden on taxpayers, especially in energy producing states, where the burden falls on communities to address the infrastructure costs associated with development including new roads, police, fire, and schools. The communities also have to address new stressors such as a temporary boom in population, housing shortages, increased need for clean air and water law enforcement, and increased crime.

Headwaters found that Montana taxpayers were getting $800,000 less revenue per wellhead than their neighbors in North Dakota because they had a lower tax rate on production.

The only thing subsidies do is add to the bottom line of oil and gas companies which made a cool $137 billion last year (Oil Change note: that figure is just the Big 5, the American oil and gas industry as a whole made many times that amount) .

So when Republicans come to a town near you on their gas prices tour, ask them why they continue to vote to protect taxpayer handouts to oil companies.

Republicans receive 88 percent of campaign contributions made by the oil and gas industry, and they want to keep their campaign contributors happy by transferring your hard earned dollars to extremely wealthy oil corporations.

See more on Fossil Fuel Subsidies

See more on Dirty Energy Money in politics