The oil and gas industry likes you to think that, compared to oil, gas is a cleaner, greener alternative – a great bridging fuel between the hydrocarbon age and the renewable age.

The oil and gas industry likes you to think that, compared to oil, gas is a cleaner, greener alternative – a great bridging fuel between the hydrocarbon age and the renewable age.

Compared to oil, this may be so – if and it is a big if, the gas is normal conventional gas. However, as traditional gas reserves are becoming harder to find and access, often they are far from the areas of demand.

So the way that the industry gets around this is to liquefy it and then ship it in tankers across oceans to where it is needed. The only problem with this is that compared to conventional gas, just the process of liquefying it takes a huge amount of energy.

A report by HSBC, in 2008 called Oil and Carbon concluded that getting the gas to market in liquefied form “triples its carbon intensity relative to conventional gas.”

According to HSBC the kg of carbon per barrel of oil equivalent for traditional gas is 22 kg / boe and for LNG is 75 kg/boe – which is on the par with kg/boe of tar sands.

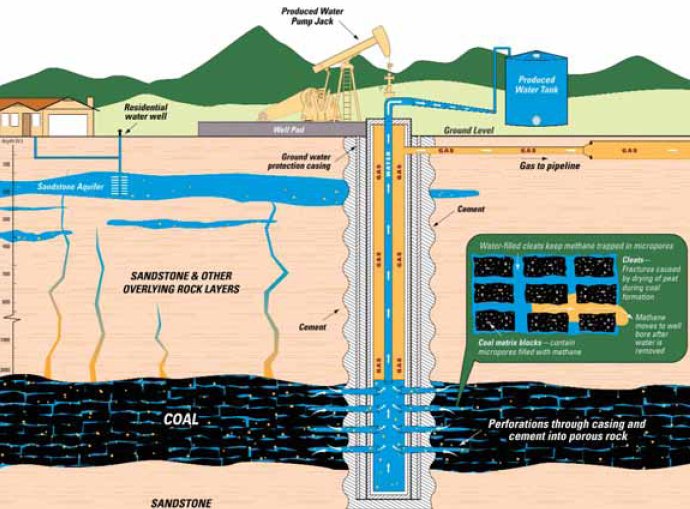

The other way oil and gas companies are looking for gas is looking for “unconventional” reserves of gas such as tight gas, shale gas and coal bed methane, sometimes known as coal-seam gas.

This is largely methane gas which is trapped in the structure of coal seams. In contrast, conventional natural gas is stored in the gaps between rock formations.

In the past decade, coal-seam gas has become an important source of energy in the United States and it became a major play in Australia.

From a climate perspective coal-bed methane (50 kg/boe) is over twice as carbon intensive as normal gas (22 kg/boe).

So what happens if you are extracting coal-bed methane and then liquefying it? You end up with a highly energy intensive energy form.

And this is what oil giant Shell is planning to do in Australia. Shell and PetroChina have underlined their desire to be significant players in Australia’s coal-bed methane gas sector by making US$3.4billion offer for Australia’s Arrow Energy. The deal does not include Arrow’s international assets, though.

Arrow is one of the leading companies in the state of Queensland that are investing billions of dollars in a race to convert reserves of coal-bed methane into liquefied natural gas.

Shell has been eying up Arrow for the best part of two years and last year made an unsuccessful bid for the company.

PetroChina’s interest is clear – it wants to secure long -term gas supplies from Australia’s coal-bed methane industry.

Arrow has responded that the offer is “nonbinding” and “conditional,” and recommended that its shareholders wait before taking action.

The media do not understand just how energy intensive liquefying gas from coal bed methane deposits is. The Telegraph argues the fuel “burns more cleanly than both coal and oil.”

But how can a gas that takes more energy to get to market than even oil from tar sands, be described as “clean”?